Tax-Smart Compliance

Are you taking advantage of all the legitimate deductions, credits and strategies the tax code offers? Do you have the right benefit plans for yourself and your employees? Do you have the right retirement plan to prepare for your future? You need concepts and strategies that leave more on your bottom line, without raising “red flags” or straying into “gray areas.”

Tax Return Preparation – Just want to get the returns completed for timely compliance? We have a team of professionals to help you get it done!

Real Estate Transactions – 1031 Exchange? Capital Gain? Homeowner Exemption? How about Installment Sales to defer capital gain? We work extensively with real estate investors, homeowners, real estate brokers and loan officers, so that you can learn what is the most optimal solution for your property.

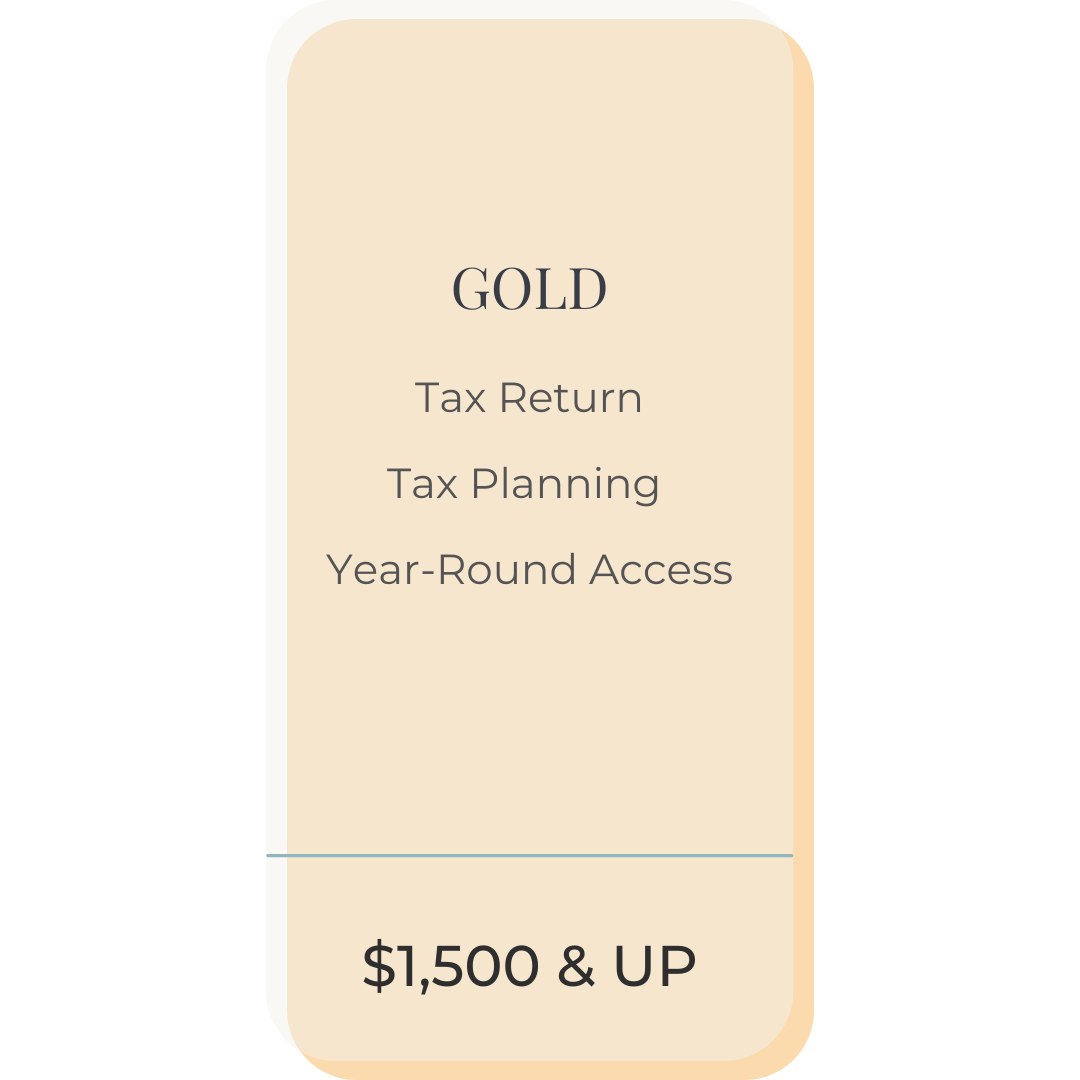

Service Packages

Personal Tax Organizer

Bay CPA Plus recommends using a Tax Organizer to help you maximize your personal and business tax savings and get the most out of your tax consultation.

Business Tax Organizer

Self-employed, entrepreneur or a business owner? CPA Plus recommends using this Business Tax Organizer to help you prepare for our meeting and make tax season stress free!

Tax Withholding Estimator

IR-2019-139, August 6, 2019 — The Internal Revenue Service today launched the new Tax Withholding Estimator, an expanded, mobile-friendly online tool designed to make it easier for everyone to have the right amount of tax withheld during the year.

Where Is My Tax Refund?

You can check in on the status of your federal tax refund using the IRS.gov website. To get started, you’ll need:

Social security number or ITIN

Your filing status

Your exact refund amount

If you’re checking from a mobile device, download the IRS2GoApp

The Dos and Don'ts of IRS Audits

Every year the Internal Revenue Service audits a number of U.S. businesses. Knowing how to prepare for and handle an audit can minimize stress and even provide opportunities to improve company operations. In some cases, audits may even lead to smaller tax bills.

Regardless of the type of IRS audit you and your business are involved in (correspondence, office or field audit), the best way to deal with an audit is to know what to do and not to do.